Taxpayers are overburdened by debt and rising cost of living, Dr. Friday says

14 January 2025

14 January 2025

By Admin. Updated 10:52 p.m., Tuesday, January 14, 2025, Atlantic Standard Time (GMT-4).

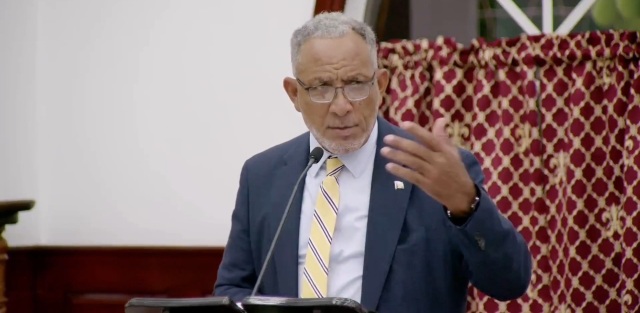

Leader of the Opposition in Parliament Dr. Godwin Friday said taxpayers in St. Vincent and the Grenadines (SVG) are overburdened by debt and the rising cost of living.

He was making his contribution to the National Budget today (January 14) in Parliament and decrying the government’s planned borrowing for the 2025 fiscal year.

Dr. Friday said: “Creating more debt puts more pressure on the people of this country and taxpayers are overburdened by debt. They are overburdened by the rising cost of living for which there is no relief in this budget.”

Dr. Friday has again called on the government to implement measures such as decreasing the Value Added Tax (VAT) and implementing an annual bonus, among other measures to ease the burden of the citizens.

During his presentation, he also called on the government to be more responsible and indicated that an NDP government would create a return to the times when the country’s current account had an annual surplus.

The Minister of Finance – Camillo Gonsalves, during his presentation of the 2025 Estimates of Revenue and Expenditure revealed that the National Debt stands at EC$2,856,977,932 (2.85 billion EC dollars).

During his 2025 Budget Address on January 13, Mr. Gonsalves said the debt-to-GDP ratio is 93.6 percent, up from 73.5 percent at the end of 2019. He said the increase in the debt-to-GDP ratio is largely the product of the government’s responses to events like the COVID-19 pandemic, the La Soufriere volcanic eruptions of 2021, Hurricane Beryl in 2024, “and the cost of investing in large, necessary project that will alter our developmental trajectory for the better.”

The $1.85 billion budget is made up of $913.3 million in Current Expenditure, Amortisation and Sinking Fund Contributions of $237.4 million and Capital outlays of $698.6 million.

The Finance Minister said Budget 2025 will be financed by Current Revenue of $907.7 million and Capital Receipts totalling $941.6 million.

He said relative to the appropriation approved last year, the increases in this year’s overall Budget are mainly attributable to Current Expenditure increasing by 9.3 percent; Capital Expenditure increasing by 22.5 percent; and Current Revenue increasing by 11.9 percent; Sinking Fund Contributions remain flat, while Amortisation increases by 14.2 percent.

“Taken at a glance, Budget 2025 has a current deficit of $5.6 million and an overall deficit of $639.9 million,” he said.

Mr. Gonsalves said: “The Government of Saint Vincent and the Grenadines has remained disciplined in its borrowings to ensure that our loans are low-interest, long-term and highly concessional. These soft loans have kept our debt servicing costs relatively low, helped to preserve fiscal space, and ensured that our debt remains manageable.”

“In efforts to minimise the impacts of natural disasters on our immediate debt servicing burden, Saint Vincent and the Grenadines has taken advantage of Climate Resilient Debt Clauses (CRDC) that were negotiated with the World Bank. The Climate Resilient Debt Clauses allow for two-year

deferrals on the service of certain World Bank in the wake of significant natural disasters. This

initiative will save Saint Vincent and the Grenadines over $8 million in debt service over the next two years.”

“Barring another major natural disaster, Saint Vincent and the Grenadines committed to achieving

the ECCB target of a 60 percent debt-to-GDP ratio a decade from now. We will do this by continuing

to bolster economic growth, avoiding non-concessional borrowing, and consolidating the gains made through our recent investments in transformative infrastructure and projects,” the finance minister added.

As it relates to the cost of living, specifically, the Value Added Tax, the government has counterargued the VAT reduction saying that for every percentage point that VAT is reduced, it will create a void of millions of dollars in revenue which will affect the government’s social programmes and its contributions to the Contingency Fund.

Related News

American couple gives SVG first baby of 2025 at MCMH

Mother Impacted by Hit-and-Run Incident Thanks God Her Babies Are Okay

Public servants in SVG to get salary increase, no new taxes in Budget 2025