NIS Loans to National Lotteries Authority Spark Debate Amid Record Profits

25 January 2026

25 January 2026

By Val Matthias. Updated 3:30 p.m., Sunday, January 25, 2026, Atlantic Standard Time (GMT-4).

The National Insurance Services (NIS) has confirmed issuing multimillion-dollar loans to the National Lotteries Authority (NLA), raising questions in some circles about why a statutory body reporting record profits continues to rely on pension funds for financing.

In other circles, some people have praised the move as a revenue earner for the NIS from interest payments received from such loans.

Appearing on WEFM’s Issue at Hand program, NIS CEO Stuart Haynes disclosed that the authority has borrowed twice from the pension fund in recent years.

“The National Lotteries Authority borrowed about $6.5 million from NIS to assist with upgrading playing fields. This is the second loan they’ve received, and they have been servicing it on time and in full at 6.5 percent,” Haynes told listeners.

He added that a second loan of $7 million was approved, with $2 million already drawn down, also at 6.5 percent interest. Haynes stressed that while the loans were designed to support sports and culture, they were subject to rigorous due diligence tests to ensure repayment capacity.

The disclosure comes as the NLA celebrates its most successful year on record. In 2025, the authority reportedrevenues surpassing EC$98 million, according to General Manager McGregor Sealey. Sealey noted that lottery profits are distributed across national development areas, including sports, cultural disciplines, education, and carnival.

With such strong earnings, critics are questioning why the NLA continues to borrow from the NIS an institution tasked with safeguarding pensions for thousands of Vincentians.

Haynes defended the loans as part of NIS’s impact investment strategy, balancing financial returns with social benefits. He emphasized that the NLA has met its obligations “on time and in full,” and that the pension fund remains financially stronger today than it was three years ago. Haynes insists the loans are safe, well-managed, and beneficial to national development.

END

Related News

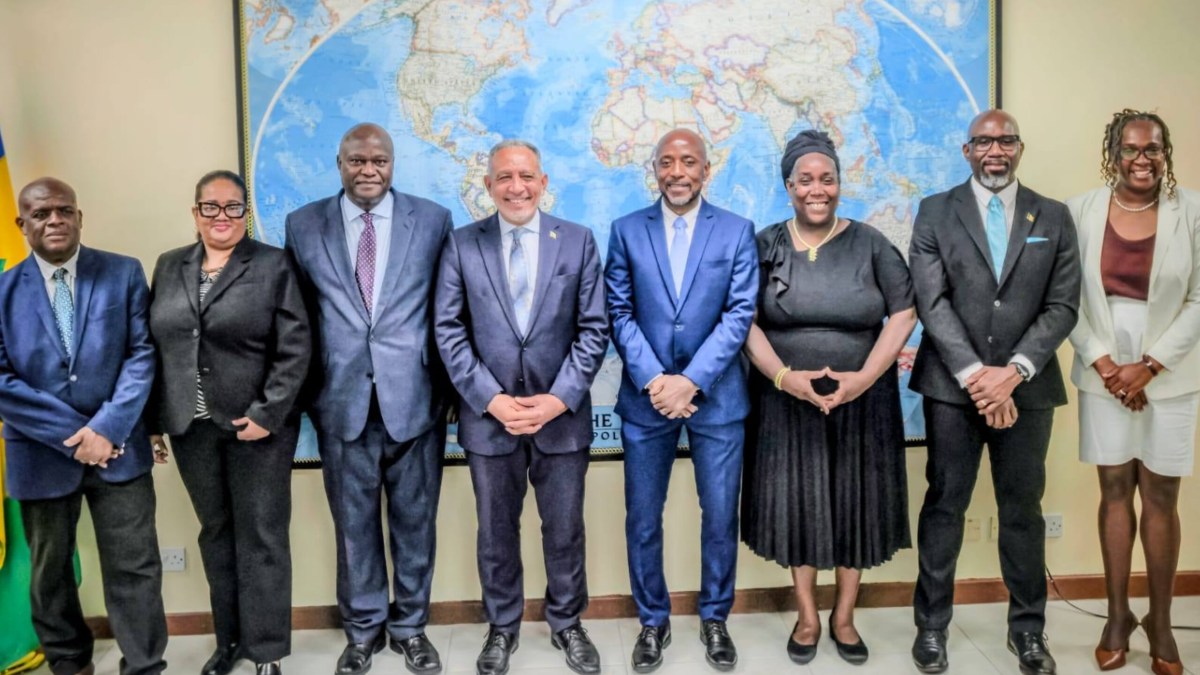

SVG Government Announces New Heads of Missions and Consulates

Man dies in suspected drowning incident

CWSA Urges Preparation of Home Water Storage as 2025 Rainfall Drops by 50%